CMA part 2 exam preparation course.

Our team has been preparing students to pass the CMA exams since 2001!

The CMA qualification has been developed for financial and management accounting professionals and for middle and senior managers working with financial information in accounting, finance and management. In addition, this qualification is ideal for entrepreneurs and managers of small businesses.

CMA combines the knowledge, skills, and professional competencies that an accountant or financial professional uses in their daily practice - financial planning, analysis, management and financial decision making.

To get the CMA certification, you must pass two parts of the exam: CMA Part 1 "Financial Planning, Business Organization and Analytics" and CMA Part 2 "Strategic Financial Management".

CMA Part 2 exam tests skills related to: financial statement analysis (20%), corporate finance (20%), decision analysis (25%), risk management (10%), investment decisions (10%), professional ethics (15%).

Training program provides the following knowledge and practical skills:

Duration: 8 lessons (64 a.h.)

Lesson 1: Financial Reporting Analysis

Calculating and interpreting financial ratios. Performance evaluation using multiple ratios. Market value versus book value. Profitability analysis. Analytical issues including foreign operations impact, price and inflation impact, off-balance sheet financing, and earnings quality.

Lesson 2. Corporate Finance

Types of risk including credit, currency, interest rate, market and political risk. Equity tools for long-term financing, initial and secondary public offerings. Dividend policy, cost of capital. Working capital management, raising capital, working capital financing. Mergers and acquisitions and international finance.

Lesson 3: Decision Analysis

Data concepts required for analysis in decision making. Cost-volume-profit analysis, margin analysis. Purchase decision making. Income tax implications for analyzing operating decisions. Pricing methodologies including market comparable approaches, cost and value based approaches.

Lesson 4: Risk Management

Types of risk including commercial, hazard, financial, operational, strategic, compliance and political risk. Risk mitigation. Risk management. Analyzing risk.

Lesson 5: Investment decisions

Estimating cash flows. Discounted cash flow concepts. Net present value. Internal rate of return, discounted payback. Income tax implications for investment decisions. Risk analysis.

Lesson 6. Professional ethics

Ethical considerations for management accounting professionals and for the businesses. Examination of all the lessons above.

Lesson 7 and 8. Exam Preparation and Practice

Comprehensive review of all topics covered in previous lessons. Mock exams and practice questions. Test-taking strategies and time management. CMA Part 2 Exam Preparation.

Mr. Darsalia has 9 years’ experience in banking, healthcare and public sectors including 3 years of management experience in M&E of government and IFI financed projects.Mr. Darsalia currently serves as Deputy Chairman of LEPL Georgia’s Innovation and Technology agency supervising Grant, Equity and Acceleration Programs, Analysis, Monitoring and Evaluation and Finance Departments. Prior to his recent position mr. Darsalia served as Head of Analysis, Monitoring and Evaluation Department at LEPL Enterpris Georgia where he was responsible for establishment of comprehensive M&E framework for SME support programs, including Micro Grants, Co-financing program, Credit Guarantee Scheme, Export support programs and TAs. He was also managing IBRD financed EUR 85 million, “Georgia Relief and Recovery for MSMEs”. Mr. Darsalia hold BSc degree from Cass Business School London in Investment and Financial Risk Management

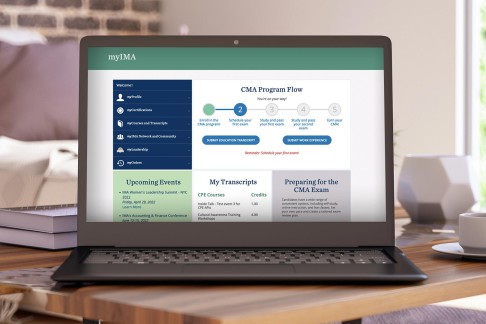

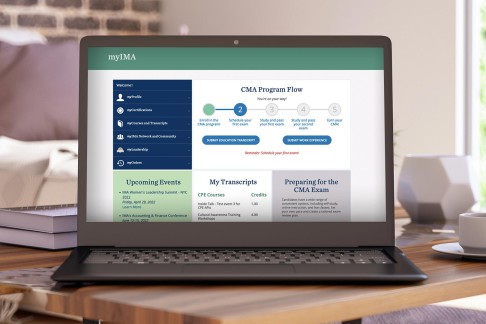

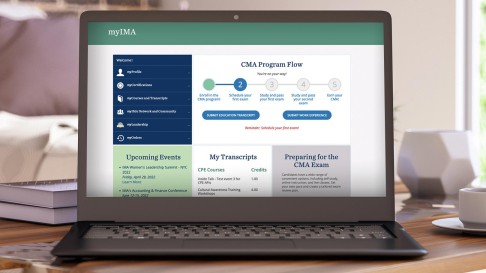

Lessons are conducted ONLINE in real time on the ZOOM platform. Trainees can communicate with the tutor and colleagues and ask clarifying questions during the training. A virtual whiteboard is used to demonstrate calculations, graphs and diagrams during each lesson. A presentation with the main ideas of each topic is shown. Study materials, practical tasks and tests, CMA books are provided. After the lesson all participants receive a video recording of the lesson and an informative and comprehensive notes from the tutor. The training process includes testing on each topic to consolidate the material covered and to practice solving exam tasks. Each student is given access to a personal account of the learning system with the ability to monitor progress.

CMA training in Georgia. Courses, test, exam, qualification, certificate | HOCK

The CMA examination consists of two parts, which are taken separately. Each exam part will consist of 100 multiple choice questions and two 30-minute essay questions. You will have 3 hours to complete the multiple choice section and one hour to complete the essays. The essays will be presented after you have completed the multiple choice section of the exam or after 3 hours, whichever comes first. Once you complete and exit the multiple choice section of the exam, you cannot go back. You must remain in the essay section to complete the exam. The essay section consists of 8-10 written response or calculation questions based on two scenarios, describing a typical business situation.

Note: You must answer at least 50% of the multiple-choice questions correctly to be eligible to take the essay section. All scores on the CMA exams are expressed as scaled scores, ranging from 0 to 500, with the passing score set at 360.

To become a certified CMA, candidates must satisfy one of the following education requirements: have a bachelor's degree from an accredited college/university or a related professional certification. CMA candidates must submit all required educational documents translated in English to ICMA within seven years of completing the CMA examination.

Candidates for the CMA certification must complete two continuous years of professional experience in management accounting and/or financial management. This requirement may be completed prior to or within seven years of passing the examination.

The path to becoming a CMA:

1. Enroll in the CMA program and become an IMA member. To start the program, you must first join IMA as a member and then enroll as a CMA candidate.

2. Schedule your exam. Testing windows are offered in January/February, May/June, and September/October. Exams are offered at Prometric testing centers.

3. Take our CMA exam preparation course.

4. Take the exam. You must sit for both exam parts within 3 years of entering the program.

5. Meet all requirements to earn the CMA (see above).

What is included in the course fee?